Table of Content

Although a 680 score is good according to FICO and VantageScore, it won’t get you the best loan terms. They instead leave it up to lenders, most of whom will be willing to issue you a mortgage with a credit score of 680. Your credit score can also affect how much you pay for services like insurance. Thankfully, a 680 credit score shouldn’t negatively affect your life. Although a 680 credit score is much higher than the lowest credit score of 300, it’s still far from the highest credit score of 850, and it’s below the current nationwide average. Some people may confuse credit utilization with debt-to-income ratio.

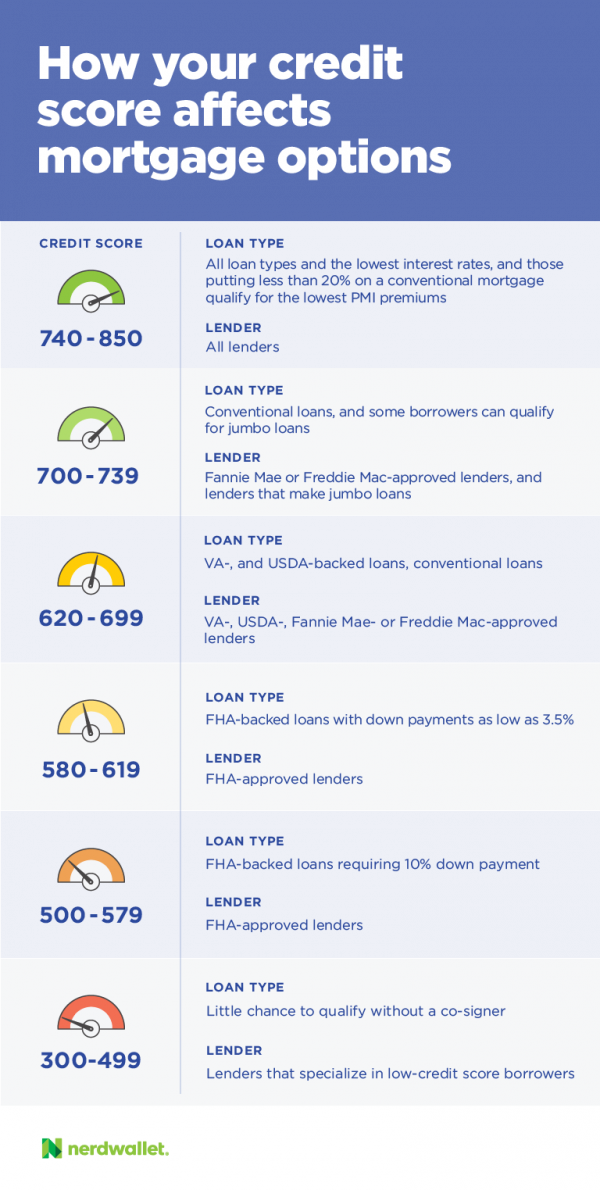

From the lender’s point of view, this type of borrower represents a greater risk than a borrower who has a good credit rating. Lenders look at more than your credit score to determine your eligibility for particular types of financing, however, having a credit score of 680 is not a bad start. Keep reading to find out your options with a 680 credit score. Homebuyers in the 680s may have to choose between an FHA and a standard loan.

LendingClub Personal Loan

A new degree may also make it easier to repay the loan if it leads to more income. One confusing aspect of credit scores for consumers is that we each have multiple scores. And the FICO score you pull through your probably isnât the same one your mortgage lender will consider. So, it is possible to get approved for a mortgage with a credit score as low as 600, but the number of mortgage lenders willing to approve your mortgage is going to be very small. A college student, however, may not require a credit score above 780, therefore a good credit score is something that changes with age. A fresh graduate is unlikely seek a mortgage, where a credit score of 640 would mean high interest rates.

Thats why its essential to improve your credit score for better mortgage rate offers from lenders. However, if you want the very best rates and terms on your loans and credit cards, then you might want to further improve your credit score. This is easy to do once you understand how credit scores work and how they’re calculated. Most lenders will lend to borrowers with credit scores in the Good range. With a score of 680, your focus should be on raising your credit scores before applying for any loans to make sure you get the best interest rates available. There are plenty of ways you can improve your credit score from the 640 range to the 680 or above range.

What does it mean to prequalify for a personal loan with a 680 credit score?

Acorn Finance only partners with reliable and trustworthy lenders. You can submit one application through Acorn Finance and receive multiple personalized pre-approval offers within seconds. They have a low down payment option of just 3.5%, making FHA loans an excellent opportunity for borrowers with low-to-moderate income.

Add this to the truth that persons are simply in search of extra space and are most likely getting sick of the restricted territory they’ve been holding into for the reason that pandemic began. So that you may perceive how sizzling the housing market has turn into. None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above. We pre-qualify you based on your answers to questions about your credit, income and employment.

The Proper FICO Rating

And you might fall back into those habits if you feel less burdened with zero balances on your credit cards. A big perk of LendingClub is that you're able to add a coborrower to your application. This means if your credit score isn't good enough to qualify for a loan, you may be able to enlist a cosigner to help.

For borrowers with conventional loans, the ability to access these “best mortgage rates” is directly linked to their credit scores. With credit builder loans, the money sits in a savings account until you’ve completed all your monthly payments. The loan payments are reported to at least one credit bureau, which gives your credit scores a boost. They also will consider your debt-to-income ratio and they may even analyze your spending habits by reviewing your personal banking statements.

WalletHub Transparency

These factors, along with your 680 score will help lenders determine what you are eligible for when it comes to a home loan. Now for your score, we’d recommend to look at conventional loans as they may give you a more favorable rate and lower mortgage Insurance. To increase your credit score, review your credit reports for errors and find out the key areas to focus on. You should then take steps to improve your credit history and maintain the good credit that you have. Which type of credit card is best ultimately depends on your financial situation and your reason for opening a new credit account. Prime mortgage borrowers — those with 20% down and a credit score above 720 — get access to the “best and lowest mortgage rates” you see advertised online and in print.

The minimum credit score needed for a personal loan with no origination fee and no collateral requirement is 660, which is fair credit. And borrowers will need good credit or excellent credit – a credit score of 700 or higher – to get the best personal loan rates. Personal loans for credit scores under 700 tend to be for relatively low amounts and have high APRs.

In addition to a good credit score, you'll need proof of your employment and ability to repay to determine eligibility. Lenders will check your debt-to-income ratio to ensure you haven't borrowed more than you can feasibly pay back. OppLoans doesn't have a minimum credit score to be eligible, but its APR range is significantly higher than any lender on our list, spanning from 59% to 160%. You can take out a loan of as little as $250 from the military-focused credit union to consolidate credit card debt. You're only eligible if you are active military member, veteran, employee or retiree of the Department of Defense, or family member of someone in one of those groups. Reach Financial is another lender designed specifically for debt consolidation.

With a 20% down payment, you may avoid paying mortgage insurance and acquire a conventional loan. If you have a tiny down payment, a 3% conventional loan may be preferable than an FHA loan. The 97 loans, Fannie Mae HomeReady, and Freddie Mac Home Possible are all options.

The several credit checks you must do in order to obtain a loan may cause your score to drop by a few points. In order to maintain a greater credit limit, don’t discontinue using any of your present credit lines. This increases the rate at which your credit card is being used. In addition, the average age of your credit is also considered.

If you have a credit score of 680 and you are looking for a personal loan, you have many options that you may or may not want to explore. A credit score of 680 may be a good start if you are seeking a personal loan through your personal bank. Traditional banks typically have more strict requirements than online lenders.

WalletHub does not endorse any particular contributors and cannot guarantee the quality or reliability of any information posted. The helpfulness of a financial advisor's answer is not indicative of future advisor performance. A loan is a binding contract, and most states won’t let you enter into a binding contract unless you are at least 18.

By this point, you should make a decision on which loan to apply for. That way, you’ll have the potential for the fastest decision possible. The application will ask for basic personal information like your name and address, plus financial information like your income, employment status and monthly housing payment.

No comments:

Post a Comment